Mergers and acquisitions (M&A) represent a powerful engine for corporate growth, offering companies a strategic pathway to expand market share, access new technologies, and enhance profitability. This exploration delves into the multifaceted world of M&A, examining the strategic considerations, financial intricacies, legal complexities, and crucial integration phases involved in successfully leveraging these transactions for substantial growth.

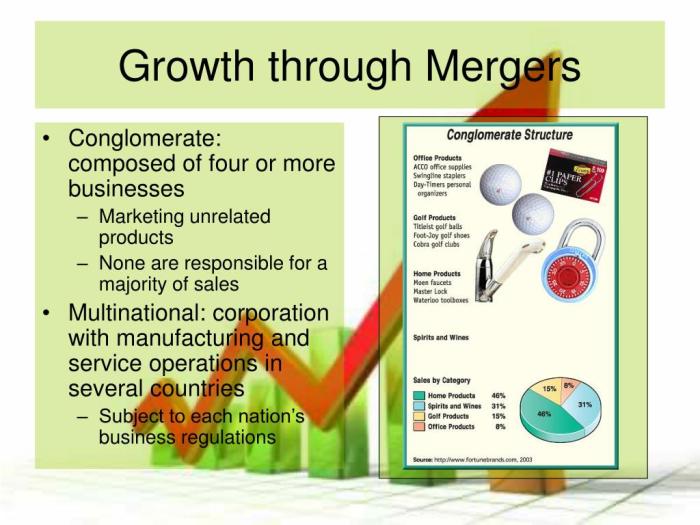

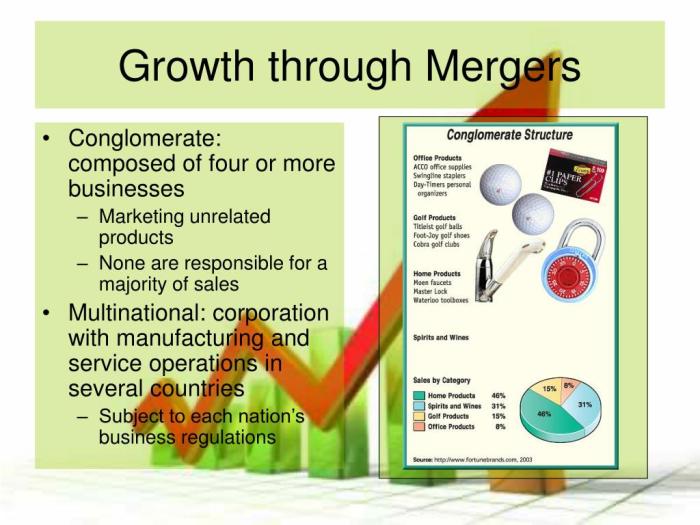

From meticulously evaluating potential targets through rigorous due diligence to navigating the legal and regulatory landscape, the journey of an M&A transaction is fraught with both opportunities and challenges. Understanding the various types of mergers—horizontal, vertical, and conglomerate—and their respective implications is paramount. Furthermore, effective post-merger integration, including robust corporate training programs, is vital for realizing the synergistic benefits and mitigating potential disruptions.

Defining Corporate Growth Through Mergers and Acquisitions

Corporate growth through mergers and acquisitions (M&A) is a strategic approach where companies combine to achieve objectives they couldn’t reach independently. This involves acquiring another company, merging with a peer, or absorbing a smaller entity. The primary driver is expansion, whether that’s increasing market share, entering new markets, or accessing crucial resources and technologies. The success of these strategies hinges on meticulous planning, effective integration, and a clear understanding of the target company’s strengths and weaknesses.Mergers and acquisitions are implemented through a variety of strategies, each tailored to specific growth objectives.

Companies might pursue acquisitions to rapidly expand their product or service offerings, acquire valuable intellectual property, or eliminate a competitor. Alternatively, mergers can create synergies, combining complementary resources and expertise to achieve greater efficiency and profitability. The choice of strategy is determined by the company’s long-term vision and available resources.

Types of Mergers and Acquisitions

Mergers and acquisitions are broadly categorized based on the relationship between the merging entities. Understanding these categories is crucial for analyzing the potential benefits and risks of a specific deal.

- Horizontal Mergers and Acquisitions: Involve companies operating in the same industry and at the same stage of production. The goal is often to increase market share, reduce competition, and achieve economies of scale. For example, the merger of Exxon and Mobil created a dominant player in the oil industry.

- Vertical Mergers and Acquisitions: Combine companies at different stages of the same supply chain. This can improve efficiency by controlling more of the production process, reducing reliance on external suppliers, and potentially lowering costs. A classic example is a car manufacturer acquiring a tire company.

- Conglomerate Mergers and Acquisitions: Bring together companies in unrelated industries. The rationale often involves diversification to reduce risk, access new markets, or leverage managerial expertise across diverse sectors. Berkshire Hathaway’s diverse portfolio is a prime example of a successful conglomerate strategy.

Examples of Successful and Unsuccessful Mergers and Acquisitions

The success or failure of an M&A deal depends on various factors, including due diligence, integration planning, cultural compatibility, and post-merger management.

A successful example is the acquisition of Instagram by Facebook (now Meta). Facebook recognized Instagram’s potential and integrated it effectively, leveraging its user base and technology to expand its social media dominance. This synergy created significant value for both companies.

Conversely, the merger of AOL and Time Warner is often cited as a major failure. Cultural clashes between the two companies, difficulties in integrating disparate technologies and business models, and a misjudgment of the evolving digital landscape all contributed to the deal’s ultimate failure. The combined entity struggled to adapt to the changing market and ultimately lost significant value.

Successful mergers and acquisitions require careful planning, thorough due diligence, effective integration strategies, and a clear understanding of the strategic rationale behind the deal.

Legal and Regulatory Considerations

Mergers and acquisitions (M&A) are complex transactions with significant legal and regulatory implications. Navigating this landscape successfully requires a thorough understanding of applicable laws and a proactive approach to obtaining necessary approvals. Failure to do so can result in significant delays, financial penalties, and even the termination of the deal.

Companies undertaking M&A activity face a multifaceted legal and regulatory environment. The process often involves navigating multiple jurisdictions and complying with various laws, depending on the industries involved, the size of the transaction, and the geographic location of the merging or acquiring entities. Key considerations include antitrust laws, securities regulations, and specific industry-specific regulations. The complexity increases significantly with international transactions.

Regulatory Approvals for Mergers and Acquisitions

Obtaining regulatory approvals is a crucial step in the M&A process. The specific approvals required vary depending on the deal’s size, industry, and geographic scope. In many jurisdictions, regulatory bodies review transactions to assess their potential impact on competition, consumer welfare, and other public interests. This review process can be lengthy and demanding, often requiring extensive documentation and responses to detailed inquiries.

For example, in the US, the Federal Trade Commission (FTC) and the Department of Justice (DOJ) scrutinize mergers and acquisitions to ensure they don’t violate antitrust laws. Similarly, in the European Union, the European Commission plays a pivotal role in reviewing large-scale mergers. The process typically involves submitting a detailed notification, undergoing an investigation, and potentially negotiating remedies to address any identified competitive concerns.

Antitrust Law Implications

Antitrust laws are designed to prevent monopolies and promote competition. These laws play a significant role in shaping the landscape of M&A activity. Regulatory bodies assess whether a proposed merger or acquisition will substantially lessen competition in a particular market. If the authorities determine that a merger is likely to create or enhance market power, they may block the deal outright or require the merging parties to divest certain assets or business lines to mitigate anti-competitive effects.

For example, the failed merger between AT&T and T-Mobile in 2011 was blocked by the DOJ due to concerns about reduced competition in the wireless telecommunications market. The scrutiny applied varies depending on the Herfindahl-Hirschman Index (HHI), a measure of market concentration. High HHI values often trigger more intense scrutiny.

Legal Process Flowchart

The legal process of a merger or acquisition is complex and multi-stage. A simplified flowchart illustrating the key steps involved is shown below:

[Imagine a flowchart here. The flowchart would begin with “Initiation of Merger/Acquisition Discussions,” leading to “Due Diligence,” then “Negotiation and Agreement,” followed by “Regulatory Filings,” then “Regulatory Review and Approval,” and finally “Closing and Integration.” Each stage would have a brief description next to it outlining the activities involved. For instance, “Regulatory Filings” might include descriptions such as preparing the necessary documentation and submitting it to the relevant authorities.

“Regulatory Review and Approval” could include details on the review process, potential requests for additional information, and the approval or rejection of the merger/acquisition.]

Integration Challenges and Post-Merger Integration Strategies

Successfully integrating an acquired company is crucial for realizing the anticipated synergies and returns from a merger or acquisition. Failure to effectively integrate can lead to significant financial losses, decreased employee morale, and damage to the brand reputation. This section explores the common challenges encountered during integration and examines various post-merger integration strategies, highlighting examples of both success and failure.

Common Integration Challenges

The integration process is often fraught with complexities. Challenges frequently arise across several key areas, hindering the smooth transition and realization of projected benefits. These challenges are often interconnected and can exacerbate one another if not addressed proactively.

- Cultural Differences: Conflicting corporate cultures, management styles, and employee values can create friction and hinder collaboration. For example, a highly hierarchical company merging with a more flat organizational structure may experience significant resistance to change and integration efforts.

- System Integration: Combining disparate IT systems, financial processes, and operational procedures can be extremely complex and time-consuming. Inconsistencies in data formats, software compatibility issues, and the need for extensive data migration can lead to delays and increased costs.

- Employee Retention and Morale: Uncertainty surrounding job security, changes in roles and responsibilities, and a lack of clear communication can negatively impact employee morale and lead to key personnel leaving the organization. This is particularly true during periods of restructuring and redundancy.

- Financial Integration: Harmonizing financial reporting, accounting practices, and budgeting processes can be challenging, particularly when dealing with different accounting standards or legacy systems. Discrepancies in financial data can delay the accurate assessment of the merger’s financial performance.

- Customer Integration: Maintaining positive customer relationships during the integration process requires careful planning and execution. Changes to service levels, pricing, or product offerings can lead to customer dissatisfaction and loss of market share. For instance, a merger between two telecom companies might lead to temporary service disruptions, causing customer frustration.

Post-Merger Integration Strategies

Several strategies exist for integrating acquired companies, each with its own advantages and disadvantages. The optimal strategy depends on various factors, including the size and nature of the acquired company, the industry, and the overall strategic goals of the acquiring firm.

- Absorption: This strategy involves fully integrating the acquired company into the acquiring company’s operations. The acquired company’s brand, operations, and systems are largely replaced by those of the acquiring company. This approach is efficient for smaller acquisitions but risks alienating employees and customers of the acquired firm.

- Preservation: This approach maintains the acquired company’s operational independence and brand identity while leveraging synergies through shared resources and strategic alignment. This works well when the acquired company possesses a strong brand and loyal customer base. However, it may limit the realization of cost savings.

- Symbiosis: This strategy involves a more collaborative approach where both companies retain their distinct identities but work together to achieve common goals. This can foster innovation and creativity but requires significant effort in managing interdependencies and potential conflicts.

Examples of Successful and Unsuccessful Integrations

The success or failure of a merger integration often hinges on thorough planning, effective communication, and strong leadership. A successful example is the merger of Visa and Plaid, where a carefully planned integration strategy prioritized customer experience and minimized disruption. Conversely, the merger of AOL and Time Warner is often cited as a case study in integration failure, largely due to cultural clashes and a lack of clear strategic vision.

Solutions to Integration Challenges

Addressing the challenges of integration requires a proactive and multi-faceted approach.

- Cultural Integration: Develop a comprehensive cultural integration plan that includes communication strategies, cross-cultural training, and team-building activities to foster collaboration and understanding.

- System Integration: Invest in robust IT infrastructure and develop a phased approach to system integration, ensuring data migration is handled efficiently and securely.

- Employee Retention: Implement clear communication strategies to address employee concerns, offer retention incentives, and provide opportunities for career development within the merged entity.

- Financial Integration: Establish a clear timeline for harmonizing financial processes and systems, ensuring accurate financial reporting and effective budget management.

- Customer Integration: Develop a detailed customer communication plan to address potential concerns and minimize disruption to service levels. Proactive communication can significantly mitigate negative impacts.

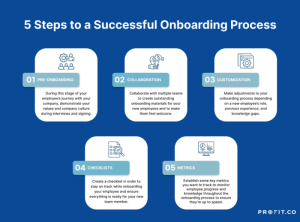

The Role of Corporate Training in Successful Mergers and Acquisitions

Successful mergers and acquisitions hinge not only on strategic alignment and financial viability but also on the seamless integration of human capital. Effective corporate training plays a pivotal role in navigating the complexities of this transition, mitigating potential risks, and fostering a unified and productive workforce. A well-designed training program can bridge cultural gaps, address employee anxieties, and ultimately contribute to the overall success of the merger or acquisition.Effective corporate training programs facilitate a smooth transition by providing employees with the necessary knowledge, skills, and support to adapt to the changes brought about by the merger or acquisition.

This proactive approach minimizes disruption, enhances productivity, and improves employee morale during a period of significant organizational change. Training should address both the practical aspects of the integration (new systems, processes, and reporting structures) and the softer aspects, such as understanding the new corporate culture and building relationships across previously separate entities.

Training Program Design for Integrating Diverse Corporate Cultures

A successful integration training program needs a multi-faceted approach, addressing the unique challenges presented by merging distinct corporate cultures. The program should begin with a thorough needs assessment, identifying the specific knowledge and skills gaps among employees from both organizations. This assessment should consider differences in communication styles, work processes, and organizational values. The training itself should be modular, allowing for flexibility in addressing the specific needs of different employee groups.

For example, leadership training might focus on conflict resolution and change management, while technical training might cover new software systems or operational procedures. Crucially, the program should incorporate opportunities for cross-organizational interaction, encouraging collaboration and relationship building between employees from different backgrounds. Role-playing exercises, team-building activities, and facilitated discussions can be valuable tools in fostering understanding and breaking down cultural barriers.

The program should also emphasize open communication, encouraging employees to express their concerns and providing a safe space for feedback.

Best Practices for Creating a Unified Corporate Culture Post-Merger

Building a unified corporate culture after a merger or acquisition requires a strategic and sustained effort. Training plays a critical role in this process by fostering a shared understanding of the new organizational values, mission, and vision. This can be achieved through workshops, online modules, and leadership development programs that emphasize the importance of collaboration, innovation, and shared goals.

The training should not only communicate the new culture but also model it. Trainers and leaders should embody the desired behaviors and values, demonstrating commitment to inclusivity and open communication. Consistent reinforcement of the new culture through ongoing communication and recognition of exemplary behavior is also crucial. For example, a company might implement a reward system that recognizes employees who exemplify the desired values, further reinforcing the new cultural norms.

Mitigating Risks and Improving Employee Morale Through Training

Proactive training can significantly mitigate risks associated with mergers and acquisitions. By addressing employee anxieties and concerns early on, training can reduce resistance to change and improve overall morale. This can include training on new technologies, systems, and processes, as well as addressing potential redundancies and changes in job roles. Training should also focus on communication skills, helping employees effectively navigate the new organizational structure and communicate their needs and concerns.

A well-designed training program can help reduce uncertainty and increase employees’ confidence in their ability to adapt to the changes, leading to higher morale and improved productivity. For example, a company experiencing a significant restructuring due to a merger could implement training programs focusing on stress management and resilience building to support employees through the transition. Another example could be providing training on conflict resolution to equip employees with the skills to navigate disagreements and foster collaboration in a newly merged environment.

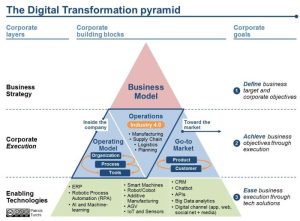

Corporate Growth and Corporate Training

Investing in corporate training is not merely an expense; it’s a strategic investment directly contributing to overall corporate growth. A well-trained workforce is more productive, innovative, and adaptable, all crucial elements for navigating the complexities of a competitive market and successfully integrating acquired companies. This synergistic relationship between training and growth is particularly evident in mergers and acquisitions, where the successful integration of diverse teams and systems hinges on the development of shared skills and competencies.

The connection between employee skill development and successful mergers and acquisitions is undeniable. A lack of training can lead to communication breakdowns, decreased morale, and ultimately, failure to realize the intended synergies of the merger. Conversely, proactive and targeted training programs can significantly mitigate these risks, fostering a smoother integration process and accelerating the achievement of post-merger goals. This translates to increased profitability, enhanced market share, and a stronger overall competitive position.

Employee Skill Development and Merger Success

Companies leverage training to improve efficiency and productivity post-merger in various ways. For instance, cross-functional training programs can break down silos between teams from different organizations, improving collaboration and information flow. Training on new software systems or processes ensures everyone is working with the same tools and methods, eliminating inefficiencies and reducing errors. Leadership training can equip managers with the skills to lead diverse teams effectively, fostering a cohesive and productive work environment.

Furthermore, cultural integration training can help bridge differences in organizational culture, minimizing conflict and promoting a sense of unity.

Examples of Training’s Impact on Post-Merger Efficiency

Consider a scenario where Company A acquires Company B, and both organizations use different Customer Relationship Management (CRM) systems. A comprehensive training program on the chosen unified CRM system would be essential. This training would equip employees from both companies with the skills to use the system effectively, ensuring data consistency, improving customer service, and streamlining sales processes. The result is increased efficiency and a significant return on the investment in training.

Another example is a merger involving two companies with differing safety protocols. A standardized safety training program would not only improve safety records but also foster a shared understanding of safety procedures across the combined organization, minimizing accidents and boosting employee confidence.

Visual Representation of the Synergistic Relationship

Imagine a Venn diagram. One circle represents “Corporate Growth,” encompassing elements like increased revenue, market share, and profitability. The other circle represents “Corporate Training,” encompassing elements such as skill development, improved efficiency, and increased employee engagement. The overlapping area, representing the synergy, is substantial and includes enhanced productivity, successful mergers & acquisitions, and a strong competitive advantage. The size of the overlapping area is directly proportional to the investment in, and effectiveness of, the corporate training programs.

This visual emphasizes that effective corporate training significantly contributes to, and amplifies, corporate growth, particularly in the context of mergers and acquisitions.

Successfully navigating the complex world of mergers and acquisitions requires a strategic, multifaceted approach. From initial due diligence and financial planning to the critical post-merger integration phase, each step demands careful consideration and execution. By understanding the financial implications, legal hurdles, and the crucial role of corporate training, companies can significantly increase their chances of realizing the substantial growth potential inherent in M&A activity.

Ultimately, successful M&A hinges on a clear strategic vision, meticulous planning, and a commitment to seamless integration, ensuring a unified and productive corporate entity.

Questions and Answers

What are some common reasons for mergers and acquisitions to fail?

Failure often stems from inadequate due diligence, unrealistic valuations, poor integration planning, cultural clashes, and insufficient attention to employee concerns.

How can cultural differences be addressed during a merger or acquisition?

Proactive communication, cultural sensitivity training, and the establishment of clear integration guidelines can help bridge cultural gaps and foster a unified corporate culture.

What is the role of a financial advisor in an M&A transaction?

Financial advisors provide expert guidance on valuation, financing options, due diligence, and negotiation, ensuring a financially sound transaction.

What are some key indicators of a successful merger or acquisition?

Successful M&A often leads to increased market share, enhanced profitability, improved efficiency, and a strengthened competitive position.