Understanding the nuances between corporate growth and business growth is crucial for any organization aiming for sustained success. While often used interchangeably, these concepts represent distinct strategies with different scopes, objectives, and measurement metrics. This exploration delves into the core differences, examining the drivers, challenges, and the intricate relationship between these two vital aspects of organizational development. We will explore how internal factors such as strategic planning and innovation, and external factors like market conditions and technological advancements, influence both types of growth.

We will dissect successful strategies employed by both large corporations and SMEs, highlighting the importance of aligning business-level initiatives with overarching corporate goals. The analysis will include a comparison of the metrics used to track progress, the inherent risks involved, and the vital role of corporate training in fostering the skills necessary to achieve ambitious growth targets. Ultimately, this analysis aims to provide a comprehensive understanding of how to effectively balance and leverage both corporate and business growth for long-term prosperity.

Defining Corporate Growth vs. Business Growth

Corporate growth and business growth, while often used interchangeably, represent distinct concepts with different scopes and objectives. Understanding these differences is crucial for strategic planning and effective resource allocation within an organization. This section will clarify the distinctions between these two growth types, providing examples and metrics for better comprehension.

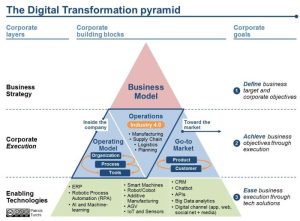

Corporate growth focuses on the expansion of a corporation as a whole, encompassing all its subsidiaries and business units. It prioritizes overall market capitalization, shareholder value, and long-term sustainability. In contrast, business growth centers on the expansion of a specific business unit or product line within a larger corporation. Its focus is on increasing revenue, market share, and profitability within that particular segment.

The key difference lies in the perspective: corporate growth takes a top-down, holistic view, while business growth adopts a bottom-up, unit-specific approach.

Examples of Corporate and Business Growth

Several companies exemplify these different growth strategies. For instance, consider a conglomerate like Berkshire Hathaway. Berkshire Hathaway’s corporate growth strategy involves acquiring diverse businesses and expanding its portfolio across various sectors, aiming for overall portfolio value appreciation. This is distinctly different from the business growth strategy employed by one of its subsidiaries, say Geico, which focuses on increasing its market share in the insurance industry through targeted advertising and improved customer service.

Conversely, a company like Apple demonstrates both corporate and business growth simultaneously. Apple’s corporate growth is evidenced by its expansion into new markets and product categories (like wearables and services), increasing its overall valuation. Simultaneously, its business growth is apparent in the continued success and expansion of its iPhone and Mac product lines.

Metrics for Measuring Corporate vs. Business Growth

Measuring corporate and business growth requires distinct metrics. Corporate growth is often assessed using metrics like market capitalization, total revenue across all business units, total assets, and shareholder return. These broad indicators reflect the overall health and expansion of the entire corporation. Business growth, on the other hand, is typically measured using metrics such as revenue growth within a specific business unit, market share, customer acquisition cost, customer lifetime value, and profit margins within that unit.

These metrics provide a more granular view of the performance and expansion of a particular business segment.

Comparison of Corporate and Business Growth Strategies

The following table summarizes the key characteristics of corporate and business growth strategies, highlighting their differences in target audience, measurement metrics, and typical outcomes.

| Growth Strategy | Target Audience | Measurement Metrics | Typical Outcomes |

|---|---|---|---|

| Corporate Growth | Shareholders, investors, stakeholders | Market capitalization, total revenue, total assets, shareholder return, EPS | Increased market valuation, diversification, enhanced brand reputation, improved financial stability |

| Business Growth | Customers, specific market segment | Revenue growth, market share, customer acquisition cost, customer lifetime value, profit margins | Increased market share, improved profitability, stronger brand recognition within a specific market, enhanced competitive advantage |

In conclusion, the journey from understanding the fundamental differences between corporate and business growth to mastering the art of aligning them is a crucial step towards achieving sustainable organizational success. While distinct in their approaches and metrics, both are intrinsically linked, with business growth fueling overall corporate expansion and corporate strategies shaping individual business unit trajectories. By carefully considering the internal and external factors influencing each, organizations can develop robust strategies that leverage the strengths of both, mitigating risks and maximizing opportunities for long-term prosperity.

The key lies in a strategic and holistic approach that integrates both perspectives, fostering a synergistic relationship that drives continuous growth and competitive advantage.

FAQ

What is the primary difference between corporate and business growth?

Corporate growth focuses on the overall expansion of the entire organization, often through mergers, acquisitions, or diversification. Business growth centers on increasing the revenue and market share of individual business units or product lines.

Can a company experience one type of growth without the other?

Yes. A company might experience significant business growth in one area while overall corporate growth remains stagnant or even declines in other areas. Conversely, corporate growth through acquisition might not immediately translate to increased revenue in each acquired business unit.

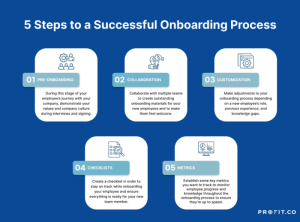

How important is employee training in achieving both types of growth?

Employee training is crucial for both. For corporate growth, it ensures employees have the skills to manage larger, more complex organizations. For business growth, it equips employees with the skills to improve sales, marketing, product development, and customer service.

What are some common mistakes companies make when pursuing growth?

Common mistakes include neglecting market research, underestimating the challenges of integration after acquisitions, failing to invest in employee development, and focusing too heavily on one type of growth at the expense of the other.