Corporate growth is the holy grail for many businesses, representing not just increased profits but also enhanced market standing and long-term sustainability. This journey, however, requires a strategic and multifaceted approach, encompassing careful planning, innovative thinking, and a keen understanding of market dynamics. From organic expansion to strategic acquisitions, the path to growth is paved with diverse options, each presenting its unique set of advantages and challenges.

This guide explores these various avenues, providing a framework for navigating the complexities of corporate expansion and achieving sustainable success.

Understanding the intricacies of market analysis, competitive advantage, and operational efficiency is crucial. Equally important is recognizing the vital role of human capital development and the implementation of robust financial strategies. This comprehensive overview will equip you with the knowledge and tools to formulate a tailored growth strategy, effectively manage risks, and measure your progress towards achieving ambitious corporate objectives.

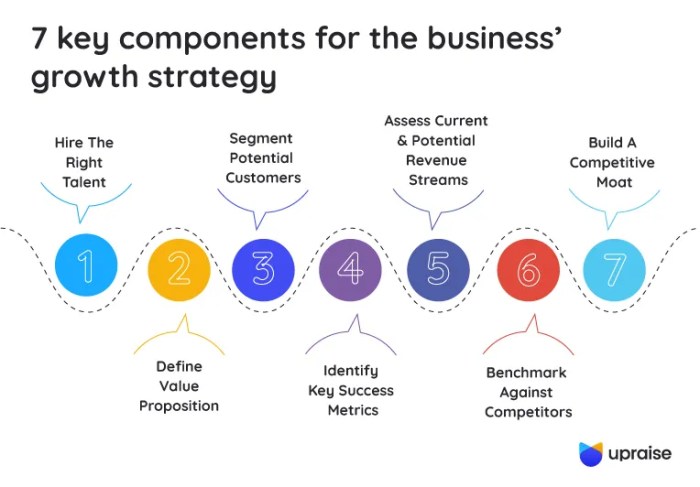

Defining Corporate Growth Strategies

Corporate growth strategies are the blueprints companies use to expand their operations and increase profitability. Choosing the right strategy is crucial, as it dictates how a company allocates resources, manages risks, and ultimately achieves its long-term objectives. Several key approaches exist, each with its own advantages and disadvantages.

Organic Growth

Organic growth, also known as internal growth, involves expanding a company’s operations using its own resources. This can be achieved through increasing sales, market share, or product lines within the existing business model. It’s a slower, more controlled approach, often relying on strategies such as improved marketing, product innovation, and enhanced customer service. Companies pursuing organic growth prioritize operational efficiency and sustainable, long-term development.

For example, Starbucks’ consistent focus on enhancing its customer experience and expanding its product offerings (e.g., adding new beverages and food items) is a prime example of successful organic growth. Another example is Apple’s continuous innovation in its product lines (iPhones, MacBooks, etc.) and its strong brand loyalty.

Mergers and Acquisitions

Mergers and acquisitions (M&A) involve combining two or more companies into a single entity. Mergers typically result in a new company, while acquisitions involve one company purchasing another. This strategy allows for rapid expansion and access to new markets, technologies, or talent pools. However, it’s often a complex and costly process, requiring careful due diligence and integration planning.

Successful M&A requires a clear understanding of the target company’s strengths and weaknesses and a well-defined integration strategy. For example, Disney’s acquisition of Pixar and Marvel significantly expanded its intellectual property portfolio and market reach. Similarly, the merger of Exxon and Mobil created one of the world’s largest oil companies, benefiting from economies of scale and increased market power.

Strategic Alliances

Strategic alliances involve collaborations between two or more companies to achieve common goals. These partnerships can take many forms, such as joint ventures, licensing agreements, or distribution agreements. Strategic alliances allow companies to share resources, reduce risks, and access new markets without the significant investment required for mergers or acquisitions. Successful strategic alliances require clear communication, shared goals, and a well-defined governance structure.

For example, the partnership between Starbucks and PepsiCo for the distribution of Starbucks’ ready-to-drink coffee beverages exemplifies a successful strategic alliance, leveraging each company’s strengths in different areas. Another example is the alliance between airlines for code-sharing and frequent flyer programs, which expands their reach and customer base.

Comparison of Corporate Growth Strategies

| Strategy | Advantages | Disadvantages | Example |

|---|---|---|---|

| Organic Growth | Sustainable, controlled growth; lower risk; improved brand loyalty | Slower growth; requires significant internal resources; may be difficult to compete with established players | Starbucks |

| Mergers & Acquisitions | Rapid expansion; access to new markets/technologies; increased market share | High cost; complex integration; potential for culture clashes; high risk of failure | Disney’s acquisition of Pixar |

| Strategic Alliances | Shared resources; reduced risk; access to new markets; faster growth | Potential for conflicts of interest; less control; dependence on partner | Starbucks and PepsiCo |

Innovation and Product Development

Innovation is the lifeblood of corporate growth. It fuels expansion into new markets, attracts and retains customers, and allows companies to stay ahead of the competition. Without a consistent stream of new ideas and improved products or services, businesses risk stagnation and eventual decline. This section will explore the crucial role of innovation in driving corporate growth and detail strategies for effective product development and market launch.Companies that consistently prioritize innovation often experience significant growth.

Apple, for example, has built its empire on groundbreaking product design and user experience, regularly introducing innovative technologies and features that redefine industry standards. Similarly, Tesla’s disruptive approach to electric vehicle technology and sustainable energy solutions has transformed the automotive and energy sectors, resulting in remarkable growth. These examples highlight the transformative power of innovation when coupled with effective execution.

Strategies for Effective Product Development and Market Launch

Successful product development involves a systematic approach that begins with identifying unmet customer needs or market gaps. This often involves thorough market research, competitive analysis, and a deep understanding of consumer preferences. Following this initial phase, a robust development process, encompassing design, prototyping, testing, and refinement, is crucial. This iterative process allows for the incorporation of feedback and ensures the final product meets the required specifications and customer expectations.Prior to a full-scale market launch, rigorous market testing is essential.

This might involve focus groups, beta testing programs, or limited-release pilots. The feedback gathered during these trials provides valuable insights into potential issues, areas for improvement, and overall market receptivity. This iterative process, incorporating feedback throughout development and testing, significantly enhances the chances of a successful product launch. For instance, a company might release a minimum viable product (MVP) to gather early user feedback before investing heavily in a full-scale launch.

Key Factors to Consider When Investing in Research and Development

Investing in research and development (R&D) requires careful consideration of several key factors. A well-defined R&D strategy is essential, outlining clear objectives, timelines, and resource allocation. This strategy should align with the overall corporate growth strategy and prioritize areas with the highest potential for return on investment.

- Market Demand: Understanding the current and future market demand for potential innovations is critical. Investing in products with limited market appeal can lead to wasted resources.

- Technological Feasibility: Assessing the technological feasibility of the proposed innovation is crucial. Projects that are technologically unachievable or require excessive resources are likely to fail.

- Competitive Landscape: Analyzing the competitive landscape helps identify potential threats and opportunities. Understanding competitors’ strengths and weaknesses informs strategic decision-making.

- Resource Allocation: Effective resource allocation is vital. This involves assigning sufficient budget, personnel, and infrastructure to the R&D project to ensure its success.

- Risk Management: R&D inherently involves risk. Developing a robust risk management plan helps mitigate potential setbacks and minimize financial losses.

A successful R&D program also fosters a culture of innovation within the organization. This involves encouraging creativity, experimentation, and collaboration among employees. Providing the necessary resources, training, and support empowers employees to contribute to the innovation process. Moreover, establishing clear metrics for measuring the success of R&D initiatives enables continuous improvement and optimization of the process.

Operational Efficiency and Cost Management

Achieving sustainable corporate growth necessitates a keen focus on operational efficiency and cost management. Streamlining processes and optimizing resource allocation are crucial for maximizing profitability and enhancing competitiveness. This involves identifying areas of waste, implementing technological improvements, and fostering a culture of continuous improvement. Effective cost management isn’t about simply cutting expenses; it’s about strategically investing resources to achieve greater returns.Operational efficiency encompasses all aspects of a business’s internal functions, from production and logistics to human resources and administration.

Improving these areas directly impacts the bottom line, allowing for reinvestment in growth initiatives or increased shareholder returns. A well-defined strategy for operational efficiency leverages data-driven insights to identify bottlenecks, optimize workflows, and eliminate unnecessary expenditures. This approach ultimately leads to increased productivity, reduced operational costs, and a stronger competitive position.

Key Performance Indicators (KPIs) for Operational Efficiency

Tracking progress toward achieving corporate growth objectives requires monitoring relevant KPIs. These metrics provide quantifiable data to assess the effectiveness of implemented strategies. Regular monitoring allows for timely adjustments and ensures that efforts are aligned with overall goals.

- Inventory Turnover Rate: Measures how efficiently inventory is managed and sold. A higher rate indicates efficient inventory management and reduced storage costs. For example, a company with a turnover rate of 10 means it sells its entire inventory 10 times a year.

- Production Efficiency: Calculated as the ratio of output to input (e.g., units produced per labor hour). Improvements reflect enhanced productivity and reduced production costs. A manufacturing company might aim to increase its production efficiency by 5% annually through process optimization.

- Customer Order Fulfillment Rate: Represents the percentage of orders fulfilled on time and accurately. High rates signify efficient order processing and logistics, enhancing customer satisfaction and loyalty. An e-commerce business striving for a 99% fulfillment rate demonstrates a commitment to timely delivery.

- Defect Rate: The percentage of defective products or services produced. Lower rates reflect improved quality control and reduced waste. A pharmaceutical company with a defect rate below 0.1% demonstrates rigorous quality standards.

Implementing Cost-Saving Measures

Implementing cost-saving measures requires a systematic approach that balances cost reduction with the maintenance of quality and customer satisfaction. A phased implementation allows for monitoring and adjustment, ensuring that savings are achieved without negatively impacting other key areas of the business.

- Identify Areas for Improvement: Conduct a thorough analysis of operational processes to pinpoint areas with high costs or inefficiencies. This could involve reviewing expense reports, analyzing production data, and conducting employee surveys.

- Prioritize Cost-Saving Initiatives: Focus on implementing measures that offer the greatest potential for cost reduction with minimal impact on quality or customer satisfaction. This might involve negotiating better deals with suppliers or streamlining administrative processes.

- Implement Technological Solutions: Invest in technology to automate tasks, improve efficiency, and reduce manual labor costs. Examples include implementing enterprise resource planning (ERP) software or automating inventory management systems.

- Monitor and Evaluate Results: Regularly track KPIs to measure the effectiveness of cost-saving initiatives. Adjust strategies as needed to maximize cost reduction while maintaining quality and customer satisfaction.

Process Optimization Techniques

Process optimization involves identifying and eliminating bottlenecks, streamlining workflows, and improving the overall efficiency of operational processes. This often involves leveraging lean manufacturing principles or Six Sigma methodologies.

Effective process optimization leads to reduced cycle times, improved quality, and decreased costs.

Human Capital Development and Corporate Training

Investing in employee training and development is no longer a luxury but a strategic imperative for achieving sustainable corporate growth. A highly skilled and engaged workforce is the backbone of a successful organization, driving innovation, improving productivity, and enhancing overall competitiveness in the marketplace. By prioritizing human capital development, companies can unlock significant potential and achieve a substantial return on their investment.A well-structured corporate training program directly impacts a company’s bottom line.

Effective training equips employees with the necessary skills and knowledge to perform their jobs more efficiently and effectively. This translates to increased productivity, reduced error rates, and improved quality of output. Moreover, comprehensive training fosters a culture of continuous learning and improvement, leading to higher employee engagement, reduced turnover, and a stronger organizational culture. Improved employee morale and satisfaction also contribute positively to customer service and overall brand perception.

The Importance of Effective Corporate Training Programs

Effective corporate training programs are designed to address specific skill gaps and organizational needs. They should be tailored to the specific roles and responsibilities of employees, incorporating a variety of learning methods to cater to different learning styles. Successful programs utilize a blended learning approach, combining online modules, classroom instruction, on-the-job training, and mentoring to maximize knowledge retention and skill development.

Regular feedback and performance evaluations are crucial components, allowing for continuous improvement and adjustment of training materials to meet evolving needs. A robust evaluation system helps to assess the effectiveness of the program and demonstrate its return on investment. For instance, a company might measure the impact of a sales training program by tracking the increase in sales revenue generated by trained employees compared to their untrained counterparts.

Sample Corporate Training Program: Customer Service Excellence

This program aims to enhance customer service skills across all departments.

| Module | Learning Objectives | Assessment Methods |

|---|---|---|

| Understanding Customer Needs | Identify and analyze customer needs; apply active listening techniques; demonstrate empathy and understanding. | Role-playing exercises, observation of interactions, written assessments. |

| Effective Communication Skills | Master clear and concise communication; handle difficult conversations; use appropriate communication channels. | Role-playing exercises, simulated customer interactions, peer feedback. |

| Problem-Solving and Conflict Resolution | Identify and resolve customer issues effectively; apply conflict resolution strategies; manage customer complaints professionally. | Case studies, group discussions, scenario-based simulations. |

| Product Knowledge and Sales Techniques | Demonstrate in-depth product knowledge; apply effective sales techniques; handle objections and close sales. | Product knowledge tests, sales simulations, customer feedback. |

Corporate Training Methodologies

Several training methodologies exist, each with its strengths and weaknesses. Choosing the right methodology depends on factors such as budget, learning objectives, and the target audience.

For example, on-the-job training provides hands-on experience and immediate application of learned skills but may lack structure and consistency. Instructor-led training offers a structured learning environment and facilitates interaction but can be expensive and time-consuming. E-learning provides flexibility and accessibility but may lack the engagement of face-to-face instruction. Mentoring and coaching offer personalized support and guidance but require significant time commitment from mentors.

A blended approach, combining multiple methodologies, often proves the most effective.

Financial Strategies for Growth

Sound financial strategies are the bedrock of sustainable corporate growth. They provide the necessary resources, control expenditure, and ensure the company’s long-term financial health, allowing for strategic investments and expansion. Without a robust financial plan, even the most innovative ideas can falter.

Securing Funding for Growth

Securing adequate funding is crucial for fueling expansion initiatives. This involves exploring various avenues to obtain capital, each with its own implications for the company’s financial structure and operational flexibility. Companies may opt for debt financing through bank loans, bonds, or private placements. Alternatively, equity financing involves selling shares of the company to investors, diluting ownership but providing significant capital injection.

A hybrid approach, combining debt and equity, is often the most practical strategy, balancing risk and control. For example, a fast-growing tech startup might secure Series A funding from venture capitalists, while a mature manufacturing company might issue corporate bonds to finance a new factory.

Cash Flow Management for Growth

Effective cash flow management is essential for sustaining growth. It involves monitoring and controlling the inflow and outflow of cash, ensuring sufficient liquidity to meet operational needs and investment opportunities. This includes optimizing accounts receivable and payable, managing inventory levels, and forecasting future cash needs. For instance, implementing robust invoicing systems and negotiating favorable payment terms with suppliers can significantly improve cash flow.

Similarly, effective inventory management prevents tying up capital in unsold goods. A company with strong cash flow management can readily seize unexpected opportunities or weather temporary financial downturns.

Optimizing Capital Structure for Growth

Capital structure refers to the mix of debt and equity financing used by a company. Optimizing this mix is vital for minimizing the cost of capital and maximizing shareholder value. A well-structured capital base can provide financial flexibility and stability, allowing the company to weather economic fluctuations and pursue growth opportunities. Factors influencing optimal capital structure include industry norms, risk tolerance, and tax implications.

For example, a highly leveraged company (high debt) might face higher interest payments but benefit from tax deductions on interest expenses, whereas a company with low debt may have lower financial risk but potentially miss out on the tax benefits. Finding the right balance requires careful analysis and consideration of long-term strategic goals.

Financial Forecasting and Budgeting

Accurate financial forecasting and budgeting are indispensable tools for guiding corporate growth. Forecasting projects future financial performance based on historical data, market trends, and management assumptions. Budgets allocate resources based on these forecasts, providing a framework for controlling expenses and monitoring progress towards growth objectives. For example, a company aiming to expand into a new market might forecast sales revenue, marketing costs, and operational expenses for the next three years.

This forecast would then inform the creation of a detailed budget, allocating funds to various departments and initiatives. Regular monitoring and adjustments ensure the budget remains relevant and effective throughout the year.

Creating a Comprehensive Financial Plan

A comprehensive financial plan serves as a roadmap for achieving corporate growth goals. It Artikels the company’s financial objectives, strategies for achieving them, and key performance indicators (KPIs) to track progress. This plan integrates elements such as securing funding, managing cash flow, optimizing capital structure, and forecasting future performance. It also incorporates risk management strategies to mitigate potential financial setbacks.

For example, a financial plan might include specific targets for revenue growth, market share expansion, and return on investment (ROI). It would also Artikel strategies for managing debt, optimizing working capital, and investing in new technologies. The plan should be regularly reviewed and updated to reflect changing market conditions and business priorities.

Measuring and Evaluating Corporate Growth

Understanding how well your corporate growth strategies are performing is crucial for sustained success. Regularly measuring and evaluating key metrics allows for timely adjustments, maximizing return on investment and ensuring the company stays on track to achieve its long-term objectives. This involves a systematic approach to data collection, analysis, and interpretation.Effective measurement requires a clear understanding of what constitutes success for your specific business goals.

While general metrics provide a valuable overview, tailoring your measurement approach to your unique circumstances will yield the most insightful results and inform the most effective decision-making.

Key Metrics for Measuring Corporate Growth

Several key performance indicators (KPIs) are commonly used to assess corporate growth. These metrics provide a comprehensive view of the company’s overall performance and highlight areas needing attention. Analyzing these metrics in conjunction with each other provides a more complete picture than analyzing them in isolation.

- Revenue Growth: This measures the percentage increase in revenue over a specific period. A consistently increasing revenue stream is a strong indicator of healthy growth. For example, a company that increased its revenue from $10 million to $12 million in a year shows a 20% revenue growth.

- Market Share: This indicates the company’s proportion of the total market for its products or services. An increase in market share suggests a successful competitive strategy and strong customer demand. For instance, if a company’s market share increases from 10% to 15%, it indicates a significant gain in market dominance.

- Profitability: This encompasses various metrics like gross profit margin, operating profit margin, and net profit margin. These metrics illustrate the company’s efficiency in generating profits relative to its revenue and costs. A consistently high profit margin indicates efficient operations and strong pricing strategies. A company with a net profit margin of 15% is generally considered to be performing well.

- Customer Acquisition Cost (CAC): This metric measures the cost of acquiring a new customer. Lower CAC indicates efficient marketing and sales strategies. If a company reduces its CAC from $100 to $80 per customer, it shows improved efficiency in customer acquisition.

- Customer Lifetime Value (CLTV): This represents the total revenue a company expects to generate from a single customer throughout their relationship. A high CLTV indicates strong customer loyalty and retention strategies. If a company’s CLTV increases from $500 to $700 per customer, it demonstrates improved customer relationship management.

Analyzing Metrics to Assess Growth Strategy Effectiveness

Analyzing these metrics involves comparing them against past performance, industry benchmarks, and the company’s own targets. This comparative analysis reveals whether the implemented strategies are yielding the desired results.For example, if a company implements a new marketing campaign aiming to increase market share and revenue, it can compare its post-campaign market share and revenue growth to pre-campaign figures and industry averages.

A significant increase above the pre-campaign levels and above the industry average would indicate the success of the campaign. Conversely, if the results fall short, it would signal a need to reassess the strategy.

Using Data Analytics to Track Progress and Make Informed Decisions

Data analytics plays a crucial role in tracking progress, identifying areas for improvement, and making data-driven decisions. By leveraging tools and techniques like dashboards, trend analysis, and predictive modeling, companies can gain valuable insights into their performance and future prospects.For instance, a company could use data analytics to identify which marketing channels are most effective in acquiring new customers, enabling them to allocate resources more efficiently.

Predictive modeling could forecast future revenue based on historical data and market trends, allowing for proactive planning and resource allocation. Regular monitoring of key metrics through dashboards provides a real-time overview of the company’s performance, allowing for prompt responses to any deviations from the planned trajectory.

Risk Management and Mitigation

Corporate growth is rarely a smooth, predictable journey. Unforeseen challenges and obstacles can significantly impact a company’s trajectory, potentially derailing carefully laid plans. Proactive risk management is therefore not merely a good practice, but a critical component of any successful growth strategy. By identifying potential threats and developing robust mitigation strategies, businesses can navigate uncertainty and enhance their chances of achieving sustainable expansion.A comprehensive risk management plan provides a structured approach to identifying, analyzing, and responding to potential risks.

This systematic process allows businesses to proactively address vulnerabilities, minimizing the likelihood of negative impacts and maximizing opportunities for growth. Ignoring risk management can lead to costly mistakes, reputational damage, and even business failure. A well-defined plan, however, allows for informed decision-making, resource allocation, and contingency planning, ultimately bolstering the organization’s resilience.

Potential Risks and Mitigation Strategies

A thorough risk assessment should consider a wide range of potential threats. The specific risks will vary depending on the industry, market conditions, and the company’s specific circumstances. However, some common risks that can hinder corporate growth include: financial instability (e.g., unexpected economic downturns, fluctuating currency exchange rates), operational disruptions (e.g., supply chain issues, natural disasters), competitive pressures (e.g., new entrants, aggressive pricing strategies), regulatory changes (e.g., new laws, stricter environmental regulations), technological disruptions (e.g., rapid technological advancements, cybersecurity threats), and human capital risks (e.g., employee turnover, skill gaps).

| Risk | Mitigation Strategy |

|---|---|

| Financial Instability (e.g., economic downturn) | Diversify revenue streams, build financial reserves, implement robust financial forecasting and budgeting processes, explore hedging strategies to mitigate currency fluctuations. |

| Operational Disruptions (e.g., supply chain issues) | Develop multiple sourcing options, build strong relationships with key suppliers, invest in inventory management systems, implement robust contingency plans for disruptions. |

| Competitive Pressures (e.g., new market entrants) | Invest in innovation and product development, build strong brand loyalty, focus on customer relationship management, explore strategic partnerships or acquisitions. |

| Regulatory Changes (e.g., new environmental regulations) | Maintain close monitoring of regulatory developments, engage with relevant regulatory bodies, invest in compliance programs, proactively adapt business practices to meet new requirements. |

| Technological Disruptions (e.g., cybersecurity threats) | Invest in robust cybersecurity infrastructure, implement regular security audits and penetration testing, develop incident response plans, provide employee training on cybersecurity best practices. |

| Human Capital Risks (e.g., employee turnover) | Invest in employee development and training, create a positive work environment, offer competitive compensation and benefits, implement robust recruitment and retention strategies. |

Importance of a Comprehensive Risk Management Plan

A comprehensive risk management plan provides a framework for identifying, assessing, and responding to potential threats. It’s not merely a list of potential problems; it’s a dynamic, evolving document that guides decision-making and resource allocation. By proactively addressing risks, businesses can avoid costly reactive measures and instead focus on strategic initiatives that drive growth. The plan should include clearly defined roles and responsibilities, regular reviews and updates, and mechanisms for monitoring and reporting on risk exposure.

A well-structured plan also helps to improve communication and coordination across different departments, ensuring a unified response to potential challenges. For example, a company facing potential supply chain disruptions might use its risk management plan to identify alternative suppliers, negotiate favorable contracts, and build up inventory reserves, all in a coordinated and efficient manner.

The Synergistic Relationship Between Corporate Growth and Corporate Training

Investing in employee development isn’t just a nice-to-have; it’s a fundamental driver of sustainable corporate growth. A highly skilled and motivated workforce is better equipped to innovate, adapt to market changes, and ultimately, increase profitability. This section explores the powerful connection between corporate training and the expansion of a business.Employee training programs directly contribute to overall corporate growth in several key ways.

Firstly, enhanced skills lead to increased productivity and efficiency. Employees who are well-trained can perform their tasks more effectively, reducing errors and improving output. Secondly, training fosters innovation. Empowered employees with updated knowledge and skills are more likely to identify new opportunities and develop creative solutions to challenges. Thirdly, improved employee morale and retention are direct results of investment in their development.

A company that values its employees’ growth fosters a more engaged and loyal workforce, reducing costly turnover and recruitment expenses. Finally, continuous learning enables a company to stay ahead of the competition. In rapidly evolving industries, upskilling employees ensures that a company maintains a competitive edge.

Examples of Successful Training Programs Driving Growth

Several companies have demonstrated the remarkable impact of employee training on their growth trajectories. For instance, Starbucks’ extensive barista training program is legendary. Their commitment to developing highly skilled baristas, knowledgeable about coffee and customer service, contributes significantly to their brand reputation and customer loyalty, leading to substantial revenue growth. Similarly, Google’s commitment to continuous learning and development for its employees, through internal training programs and external opportunities, has helped them maintain their position as a technology leader, constantly innovating and adapting to new challenges.

These companies view training not as an expense, but as a strategic investment in their long-term success.

Visual Representation of the Positive Feedback Loop

Imagine a circular diagram. At the top, we have “Employee Training and Development,” which feeds into the right side, “Increased Employee Productivity and Innovation.” This, in turn, leads to the bottom of the circle, “Improved Corporate Performance and Growth.” From there, the arrow points to the left side, “Increased Revenue and Resources,” which finally feeds back into the top, “Employee Training and Development,” completing the loop.

This illustrates how improved performance generates more revenue, allowing for further investment in employee training, creating a continuous cycle of growth and improvement. The size of each segment in the circle could dynamically increase to show the growth over time. For instance, as “Increased Revenue and Resources” grows, so does “Employee Training and Development,” demonstrating a positive, self-reinforcing relationship.

Ultimately, achieving substantial corporate growth is not a singular event but a continuous process of adaptation, innovation, and strategic execution. By carefully considering the diverse strategies Artikeld in this guide—from organic expansion and strategic alliances to efficient cost management and robust employee development—businesses can lay a solid foundation for sustainable growth. Remember, consistent monitoring, data-driven decision-making, and a proactive approach to risk management are essential elements in this ongoing journey towards sustained success and market leadership.

General Inquiries

What are some common pitfalls to avoid when pursuing corporate growth?

Overextending resources, neglecting market research, failing to adapt to changing market conditions, and underestimating the importance of employee training are all common pitfalls.

How can a small business effectively compete with larger corporations?

Small businesses can leverage agility, niche market specialization, and strong customer relationships to compete effectively. Focusing on innovation and building a strong brand identity are also key.

What role does technology play in achieving corporate growth?

Technology plays a crucial role, enabling efficient operations, data-driven decision-making, enhanced customer engagement, and access to new markets.

How important is measuring and tracking progress towards growth goals?

Regularly tracking key performance indicators (KPIs) is vital for identifying areas of success and areas needing improvement, allowing for timely adjustments to the growth strategy.